Remodeling Poll: Growth on One Side, Roadblocks on The Other

On April 22 and 23, 2025, the Joint Center for Housing Studies Remodeling Futures Steering Committee convened at Harvard University for its spring Conference, bringing together 63 remodeling industry leaders. About two-thirds attended in person, and one-third joined virtually.

Attendees represented a cross-section of the remodeling sector, including representatives from leading divisions of the sector:

- Design/build firms

- Home improvement companies

- Building product manufacturers

- Industry associations

- Trade press members

During the conference, participants engaged in a real-time poll gauging sentiment on key economic and policy issues affecting the remodeling sector. The results show industry leaders’ outlook amid evolving market conditions.

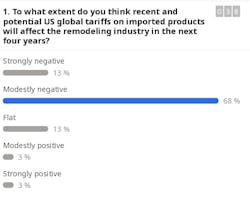

Most expect tariffs to hurt remodeling

When asked about the expected impact of recent and potential U.S. global tariffs on imported products over the next four years, an overwhelming majority (81%) anticipated a negative effect. Specifically, 68% predicted a modestly negative outcome and 13% a strongly negative one.

Only 6% expected tariffs to positively impact, and 13% forecasted no significant effect.

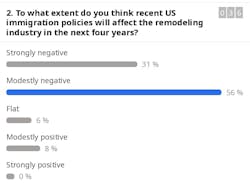

Immigration policy changes are seen as a growing risk

Regarding U.S. immigration policies, 87% of respondents projected a negative influence on the remodeling industry over the next four years. Of these, 56% anticipated a modestly negative impact and 31% a strongly negative.

A small minority (8%) saw potential for modest positive effects, while 6% expected no significant change.

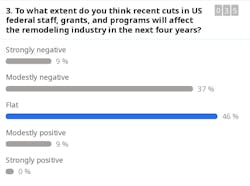

Cuts to federal programs create mixed expectations

Respondents were more divided when asked about recent cuts to U.S. federal staff, grants, and programs. While 46% believed the impact would be flat, 37% foresaw a modestly negative effect, and 9% a strongly negative one.

Only 9% expected a modestly positive outcome.

Remodeling should remain steady or grow modestly

Looking ahead to the next half-year, the sentiment was generally stable to positive. A plurality (36%) projected a flat market, while 33% expected modest growth. Another 22% anticipated a modest downturn, and 8% foresaw strong growth.

Notably, no participants predicted a strong downturn.

Bottom line: cautious optimism with underlying policy concerns

These findings provide a real-time snapshot of the expectations and apprehensions among leading voices in the remodeling industry: cautious optimism for short-term remodeling, tempered by significant concern over tariffs and immigration constraints.

About the Author

Dan Morrison

Dan Morrison is a founding editor of ProTradeCraft.com, where he is also the editor-in-chief. Fun fact: Dan is also a founding editor of Green Building Advisor and executive editor of Fine Homebuilding.